One of the most important elements of a sound financial plan that anyone working with Independent Financial Planning would address early on is having an “emergency fund,” money set aside for an unforeseen spending need. It happened for me one Tuesday evening when my wife was accelerating from a stop light on a divided highway and an out-of-control drunk driver entered the highway from the exit ramp. In less than five seconds her Ford Explorer, which helped save her life, was totaled in a head-on collision. Yes, thankfully, we had insurance but we also had our emergency fund so finding a new used car didn’t put us in a situation where we were forced to take a loan. We had the funds set aside for just such an event.

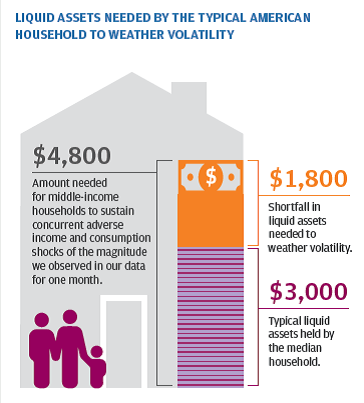

Don’t just take my word for it. JPMorgan Chase Institute, a global think tank, recently published a report entitled, Weathering Volatility. One of it’s core findings is that the average household does not have enough immediately accessible savings to handle even a relatively mild (25% to 75%) variation of increased expenses for whatever reason coupled with a decline in income. In most situations, the general rule for an emergency fund is three to six months of expenses. In the graphic from the report below, you’ll see that the “typical American household” would need $4,800 to weather volatility. In most cases a fully funded emergency fund would be more than that.

So how much should you have in your emergency fund? You should know the answer from Independent Financial Planning, “it depends.” Everyone’s situation is unique. In northern Virginia there are a lot of government employees who have very stable incomes. While they may need some savings to stave off the improbable but too frequent government shutdown, the chances they’ll be missing paychecks while having unexpected large expenses is less than an independent contractor. It’s important to have enough in an emergency fund but too much can also be a problem, since these funds are not earning a real (above inflation) return. Here is another graphic from the report showing the cash buffers for different income quintiles.

I hope this brief look into emergency funds and a cash buffer has been helpful. If you don’t have a cash buffer you need to make that a high priority to address. At Independent Financial Planning, I often use the analogy of a bucket under a spout. The spout is pouring (or dripping) savings each month and the bucket you put under the spout is where you direct that savings. Start by directing it to the emergency fund until it’s fully funded and then look to the next best option. Perhaps for you that’s a Roth IRA, but yes, it depends.